for your business

Finance $10,000 to $5 million

Terms vary per client

A business line of credit is a flexible, revolving financing option that lets you borrow funds as needed—similar to a credit card. You only pay interest on what you use, and once repaid, the funds become available again. It’s ideal for managing cash flow, covering unexpected expenses, or seizing short-term opportunities.

Get matched with the best financing options with the highest funding amounts.

Our fintech speed can get you in and out of Underwriting in just a few hours – and same day funding!

Qualify for our leading financing options with as little as six months of business history.

The minimum revenue to qualify for financing options are $10,000 per month, or $120,000 in annual gross sales.

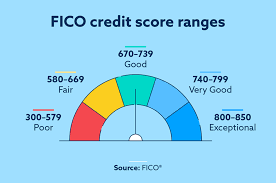

We have financing options for all credit profiles. The minimum FICO score required to apply is 600.

With nothing but positive feedback, our Success Advisors are trusted partners who work alongside you to overcome your toughest business challenges.

At Finance Pros Inc, we leverage advanced AI technology to simplify the funding process. Get pre-approved quickly with flexible loan options tailored to your business goals.

Review multiple loan offers side by side and select the one that aligns best with your business goals—no pressure, just options that work for you.

With Finance Pros Inc you’ll see all your terms upfront—clear, honest, and hassle-free financing with zero guesswork.

Finance Pros Inc – Experience fast funding and exceptional customer care—Getting started is simple and hassle free.

Step 1. Apply Securely Online

Our quick and simple application process delivers fast pre-approvals—no hassle, no delays.

Step 2. Review Your Options

Your dedicated Success Advisor will walk you through the best financing options tailored to your business needs.

Step 3. Receive Your Funds

Finish the online application process and receive your funds.

Business Owner

I’ve had the pleasure of working with Finance Pros and highly recommend them. Their professionalism, expertise, and dedication to supporting small businesses are exceptional. They took the time to understand my unique needs and delivered a tailored lending solution that was both fair and aligned with my strategic goals.

We’re here to empower businesses to move forward by offering today’s most effective business and commercial lending solutions.

Our Success Advisors are Empowered to Help You Succeed!

855-424-FUND (3863)

info@financeprosinc.com